What's happening to canola use in Canada?

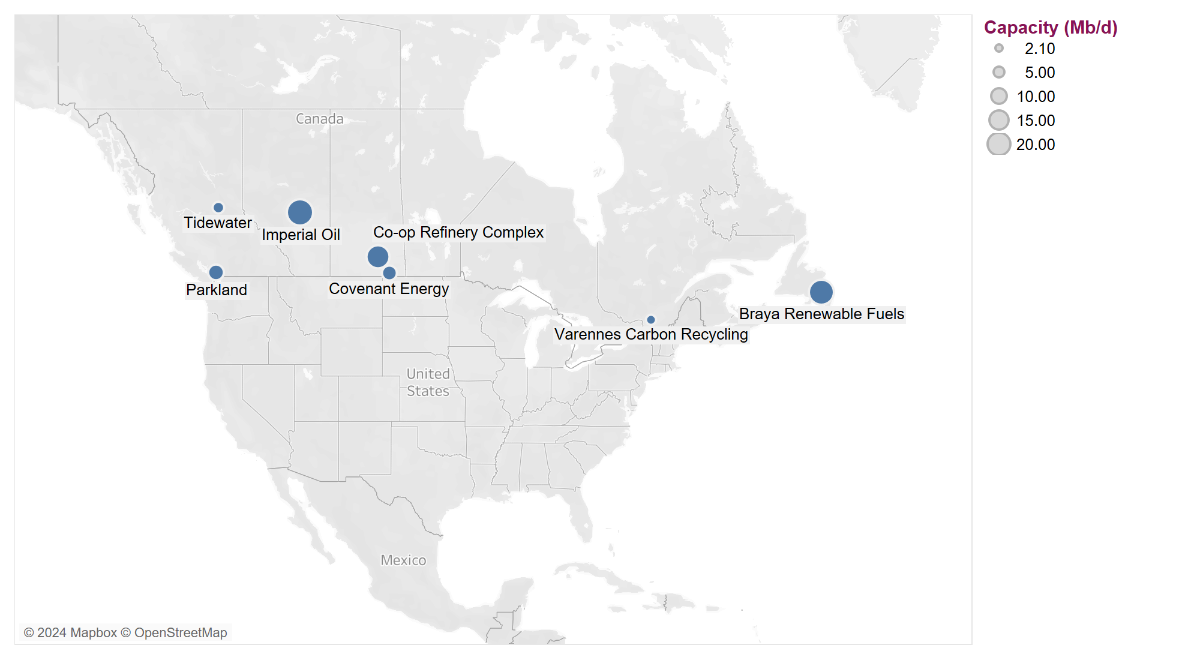

Seven renewable diesel facilities under construction in Canada are set to consume an estimated seven million tonnes of canola oil and seed previously earmarked for export, setting Australia up for increased demand.

Market forces will tip in Western Australia’s favour if more of Canada's annual production is consumed domestically.

The Canadian Energy Regulator aims to reduce the carbon intensity of gasoline and diesel used in Canada by around 15% (compared to 2016 levels) by 2030.

If Canada substantially increases its domestic crush to service new domestic demand for oil and continues to meet existing demand for oil exports to the United States, we expect this will see a decrease in exports.

Existing and planned Canadian renewable diesel facilities. Source: Canada Energy Regulator

What is renewable diesel?

- Biodiesel is manufactured by transesterification of vegetable oils and mineral fats. Biodiesel is blended with petroleum diesel.

- Renewable Diesel is produced using a hydrogenation process like the process used for desulphurization of petroleum diesel. Because of this, existing petroleum refineries can be converted for renewable diesel.

- Canada’s Clean Fuel Regulations (CFR) are a set of rules and requirements implemented by the Canadian Government to reduce greenhouse gas (GHG) emissions from the transportation sector.

- The objective of the CFR is to notably reduce pollution by enhancing the cleanliness of the fuels utilised. These regulations necessitate suppliers of liquid fossil fuels (gasoline and diesel) to progressively diminish the pollution levels of the fuels they manufacture and distribute for usage in Canada

How will this impact on Canadian canola exports?

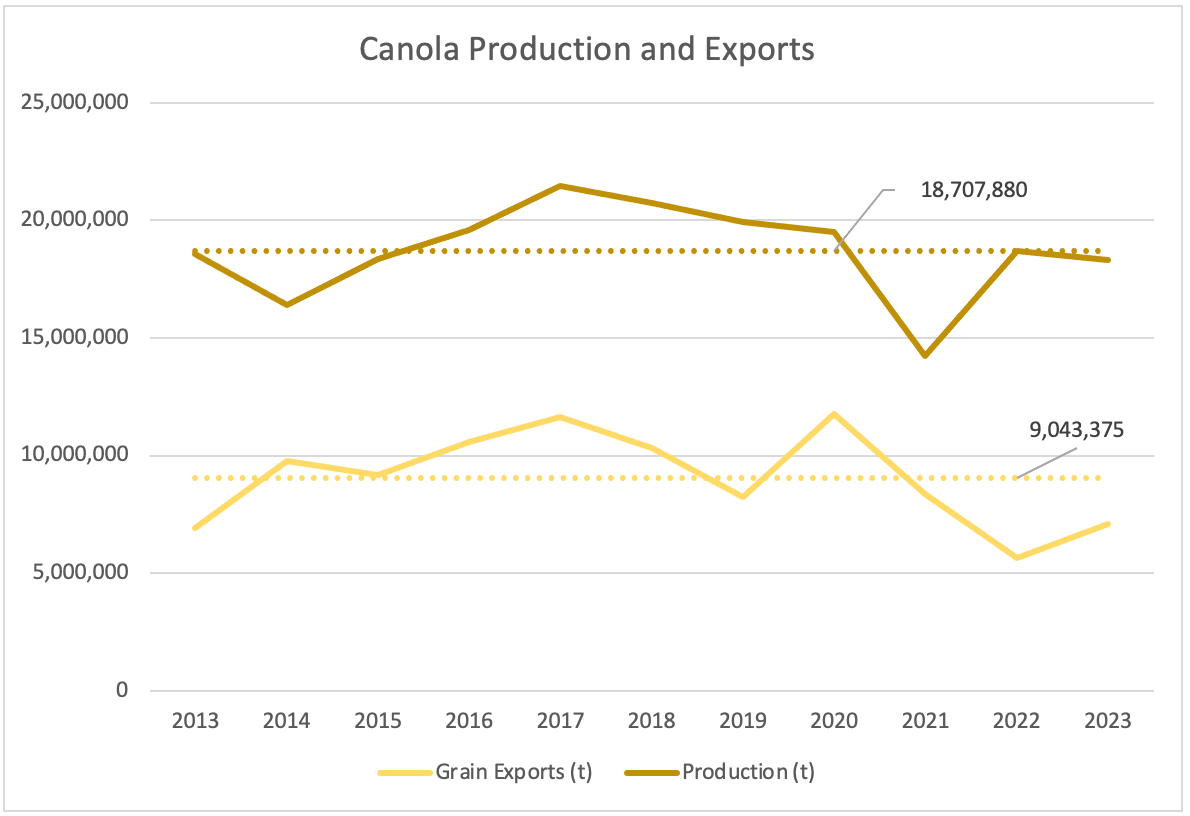

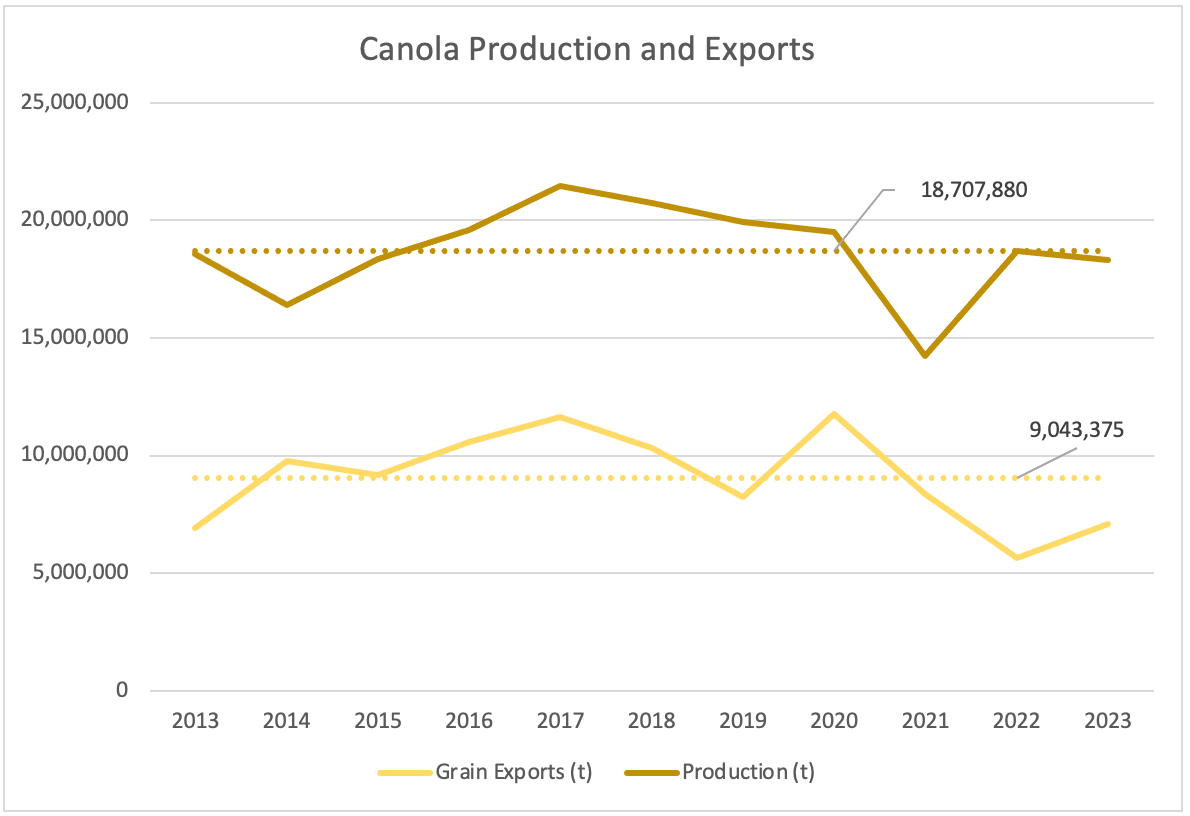

Canadian canola production has remained relatively stable, averaging 18.7mmt, with exports averaging 9mmt of seed over the past decade and 3.07mmt of canola oil on average over the last five years.

This is potentially an opportunity for Western Australian canola producers as it could mean less exportable surplus from Canada to compete into our contestable markets, particularly if Canadian production is not strong in any given year.

The CFR regulations mean suppliers of liquid fossil fuels such as gasoline and diesel must progressively reduce the pollution levels.

With at least 2% of diesel and 5% of petrol products required to be renewable (25% less GHG than the petroleum equivalent) and these figures likely to grow to reach emissions goals, we see an upside for West Australian growers.

Renewable diesel can utilise a range of feedstocks, however, canola oil is likely to supply a large amount of Canada’s industry due to its proximity to refineries and larger production. Almost three times as much canola is grown in Canada than soybeans.

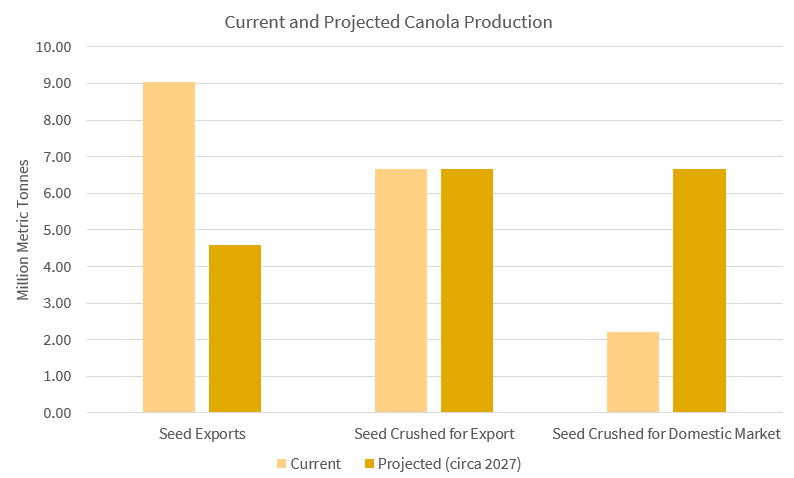

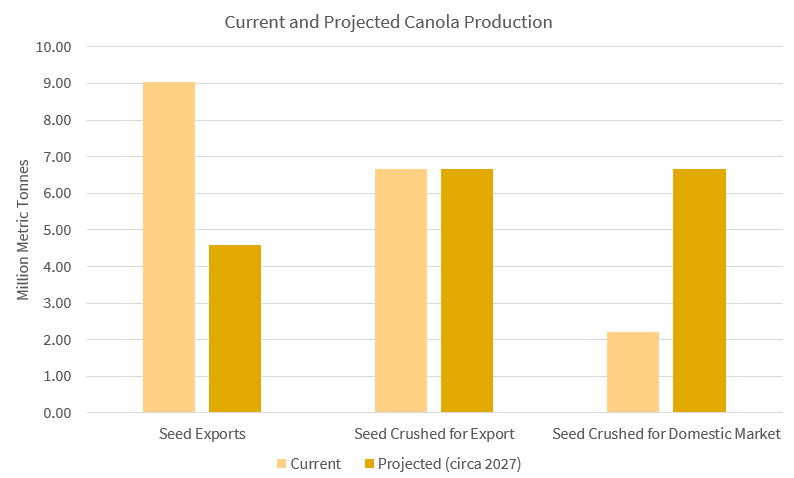

The Canadian domestic crush capacity of canola steadily increased since 2013. This will increase further as Canada strives for its target of 4.07 billion litres of renewable diesel per year in 2027, assuming Canada maintains its canola oil exports.

Last year, just 1.27 million tonnes of canola oil was consumed on the Canadian domestic market, significantly lower than the estimated 3.85 million extra tonnes required to reach the target. This assumes only canola oil is used for renewable targets.

The United States accounted for more than two-thirds of Canadian exports, with the market driven by its own biodiesel demand.

- Production has remained relatively stable, averaging 18.7 million tonnes over the last 10 years.

- Exports average 9 million tonnes, with substantially lower exports in the past two years as a consequence of a substantially lower crop in 2021.

Using the following assumptions, we have projected that Canada's canola seed exports could halve from 9mmt to 4.5mmt by 2027.

- 75% of biofuel feedstock consumption will be canola oil.

- Current canola oil exports will remain constant.

- Canola production remains in line with the 10-year average.

What does this mean for Western Australian canola growers?

Agvise expects Canada's push towards renewable fuels will benefit WA canola growers as it focuses on domestic canola crush and the US export market.

This outlook is positive for WA canola producers as it will mean less exportable surplus from Canada to compete into our contestable markets, particularly if Canadian production is not strong.

To discuss this further, give Jacinta Kelly a call on 0447 996 200.

Further Reading

Government of Canada, C. E. R. (2023, November 24). Market Snapshot: New Renewable Diesel Facilities Will Help Reduce Carbon Intensity of Fuels in Canada. Canada Energy Regulator . https://www.cer-rec.gc.ca/en/data-analysis/energy-markets/market-snapshots/2023/market-snapshot-new-renewable-diesel-facilities-will-help-reduce-carbon-intensity-fuels-canada.html

Government of Canada, S. C. (2024, February 26). Canadian International Merchandise Trade Database. Government of Canada, Statistics Canada. https://www150.statcan.gc.ca/n1/en/catalogue/65F0013X

Government of Canada, Statistics Canada. (2024a, January 24). Crushing statistics of major oilseeds.https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3210035201

Government of Canada, Statistics Canada. (2024b, February 8). Government of Canada, Statistics Canada. Estimated areas, yield, production, average farm price and total farm value of principal field crops, in metric and imperial units. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3210035901

How do I engage Agvise to help me with grain marketing?

To discuss your grain marketing needs, contact Jacinta Kelly on 0447 996 200 or jkelly@agvise.com.au. Or speak with your Agvise financial management consultant.